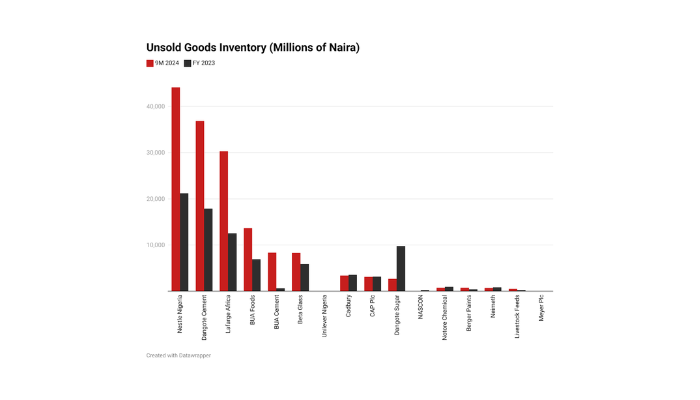

Manufacturers listed on the Nigerian Exchange (NGX) are grappling with a sharp rise in unsold goods, with their combined inventory surging by 87 percent in the first nine months of 2024. Data reviewed by BusinessDay shows that 16 companies recorded a total of N161.1 billion in finished goods inventory, up by N74.85 billion from the N86.3 billion recorded at the start of the year.

The increase in unsold goods reflects ongoing challenges in the manufacturing sector, corroborating a report by the Manufacturers Association of Nigeria (MAN), which revealed that unsold goods inventory across the sector hit N1.24 trillion in the first half of the year.

Nestlé Nigeria recorded the largest unsold finished goods inventory among the companies, with N44.1 billion as of September 30, 2024. This represents a significant rise from N21.2 billion at the start of the year. The company continues to face financial difficulties, with net losses expanding to N184.3 billion during the nine-month period, alongside a negative equity position of N112.1 billion. Despite these challenges, Nestlé recorded a turnover of N665.3 billion, representing a 68 percent year-on-year growth.

Dangote Cement, another major player, saw its unsold finished goods inventory rise by 106 percent to N36.8 billion from N17.9 billion earlier in the year. While the company produced 20.674 million tonnes of cement during the nine months, its growing inventory signals that sales may not be keeping pace with increased production capacity.

Lafarge Africa also reported a sharp increase in unsold inventory, which rose to N30.3 billion from N12.5 billion at the start of the year. The cement maker generated N479.5 billion in revenue during the nine months and recorded a net profit of N60.1 billion, underscoring its relative financial stability despite the inventory growth.

In the consumer goods sector, BUA Foods saw its finished goods inventory almost double to N13.6 billion, marking a 97 percent increase from N6.9 billion at the start of the year. Unilever Nigeria reported a 146 percent surge in unsold goods inventory to N5.3 billion, up from N2.2 billion earlier in the year, while achieving a net profit of N11 billion during the same period.

On the other hand, Cadbury Nigeria’s unsold goods inventory declined by 5 percent to N3.4 billion, from N3.6 billion recorded earlier in the year. Similarly, Chemical and Allied Products Plc, a subsidiary of UAC Nigeria, reported a marginal decline in its inventory to N3.12 billion from N3.16 billion at the start of 2024.

Some manufacturers experienced significant reductions in their unsold inventory. Dangote Sugar recorded a dramatic decline, with its inventory dropping from N9.8 billion to N2.7 billion, despite the group posting a net loss of N184.4 billion during the period. Notore Chemicals and Berger Paints also saw declines in their inventories, with Notore’s dropping by 19 percent to N759 million and Berger’s falling to N732 million from N416 million earlier in the year.

The increase in unsold goods inventories reflects broader challenges in the Nigerian manufacturing sector, including declining consumer purchasing power, inflationary pressures, and operational inefficiencies. Stakeholders have called for urgent government intervention to stimulate demand and address structural challenges, as manufacturers continue to navigate a difficult economic environment.